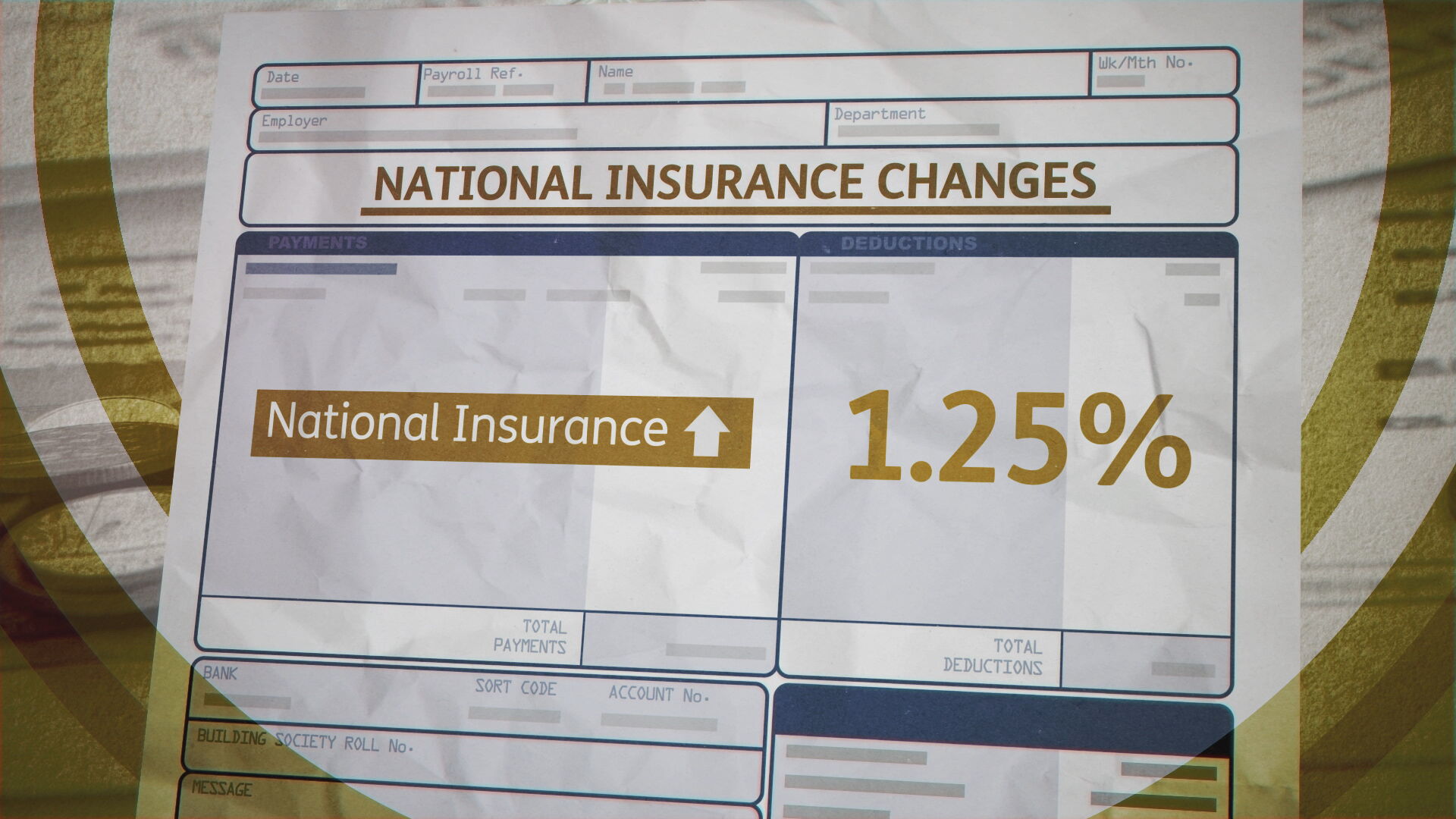

It is difficult to keep up due to the amount of UK Government changes recently however, a reminder that from Sunday 6 November 2022, the temporary 1.25% increase in employer and employee National Insurance rates which have been paid since April this year, are being reversed for the rest of the financial year.

The 1.25% increase was for the Health and Social Care Levy, which will no longer go ahead.

The introduction of a separate Health and Social Care Levy tax in April 2023 has also been cancelled.

Your Payroll department need to look at removing the ‘1.25% uplift in NICs funds due to NHS, health and social care’ wording from employee’s pay slips.

The Chartered Institute of Payroll Professionals (CIPP) stated that the change will see 920,000 business pay less in NI and 20,000 stop paying NI all together. The Government estimates that this will save individuals £330 on average for 2022-23 and £135 for the rest of this tax year.